Biden to mention for very first-date homebuyer taxation credit, structure regarding dos million residential property

Why does that work having a card relationship?

4 listopadu, 2024Q&A: How to Financing a property Restoration having property Guarantee Financing?

4 listopadu, 2024- Click to share into the LinkedIn (Reveals for the the newest screen)

- Mouse click to help you current email address a link to a pal (Reveals into the the fresh new window)

- Click to talk about to the Sms (Opens when you look at the the newest windows)

- Mouse click to duplicate link (Opens in the the newest screen)

The brand new White Household announced that Chairman Joe Biden will-call into lawmakers in the home from Agencies while the Senate to deal with some houses situations in the County of the Commitment address, which can be delivered to a joint example out-of Congress and you will televised around the world for the Thursday nights.

About target, the newest chairman will-call to own a $10,000 taxation credit for earliest-go out homeowners and people who promote their beginner property; the development and you can recovery greater than dos mil even more homes; and cost decreases getting tenants.

Biden will additionally need straight down homebuying and you will refinancing settlement costs and you will break upon corporate actions one rip off clients, with regards to the Light House statement.

The borrowed funds relief borrowing would provide middle-group earliest-time homebuyers having a yearly tax borrowing from the bank out-of $5,000 annually for 2 ages, with respect to the statement. This should act as an equivalent to decreasing the mortgage speed from the more step one.5% into the an average-charged domestic for a couple of years, and is also estimated so you can let over step 3.5 mil middle-category parents purchase their first household along side next couple of years, this new Light Domestic said.

The latest chairman might require a unique borrowing from the bank so you can unlock collection away from affordable beginning land, when you are helping center-group family change the new casing ladder and you may empty nesters correct size, new Light Home said.

Approaching rate lock-inches

Home owners just who benefited regarding the article-pandemic, low-rates environment are generally alot more unwilling to promote and present upwards its speed, even though their products may well not complement their needs. The latest White Home is trying incentivize those who do work with off a different sort of the place to find offer.

This new chairman was calling on Congress to add a single-season tax borrowing as much as $ten,000 so you’re able to middle-classification group which promote its beginner family, recognized as house underneath the area median family price in the state, to another proprietor-tenant, the newest statement told me. This proposal are projected to help nearly step three billion family members.

“ data-large-file=““ tabindex=“0″ role=“button“ src=““ alt=“The official White Household portrait away from Chairman Joe Biden, used .“ style=“width:200px“ srcset=“ 765w, 120w, 240w“ sizes=“(max-width: 765px) 100vw, 765px“ /> Joe Biden

The new president will also reiterate a trip to add $twenty-five,000 inside the down payment guidelines getting very first-generation homebuyers whose family have not benefited regarding the generational wide range building with the homeownership, that’s projected to assist 400,000 family, with regards to the White Domestic.

The newest White House and additionally mentioned history year’s prevention for the mortgage premium (MIP) for Federal Casing Administration (FHA) mortgages, and therefore save yourself a projected 850,000 homeowners and you can property owners an estimated $800 a-year.

Into the Thursday’s County of your Relationship target, new chairman is anticipated so you can mention the brand new strategies to lessen new closing costs with the to get a beneficial house or refinancing mortgage, plus a federal Housing Finance Company (FHFA) airplane pilot system who waive the necessity for lender’s name insurance policies to your certain refinances.

The White Domestic says you to definitely, when the enacted, this should conserve thousands of people as much as $step 1,500 – otherwise normally $750.

Also have and you can rental demands

Housing likewise have continues to be problematic towards wide housing business, while the president will-call to the Congress to pass through statutes to build and upgrade more than dos mil home, which could intimate the fresh new houses supply gap minimizing housing will cost you to have tenants and you will residents, new White Domestic said.

This will be done by a growth of your own Lowest-Money Houses Taxation Borrowing from the bank (LIHTC) to build or preserve 1 3k loan no credit check Old Saybrook Center CT.2 mil sensible rental equipment, along with a unique People Homes Taxation Borrowing who would make or renovate affordable house to have homeownership, that will resulted in design otherwise preservation of over 400,000 starter home.

An alternate $20 million, aggressive give program the fresh president is anticipated to help you expose when you look at the speech would also contain the framework from sensible multifamily rental equipment; incentivize regional tips to eradicate so many traps so you can homes creativity; pilot imaginative habits to increase producing sensible and workforce rental houses; and you can encourage the building of new beginner home to have center-group group, the latest White House said.

Biden will even propose that each Government Mortgage Lender double their annual sum on the Reasonable Construction System, increasing they from 10% away from past 12 months net income in order to 20%. The new Light Home rates this particular tend to improve an additional $step 3.79 mil to have reasonable property over the second several years and you may help almost 380,000 house.

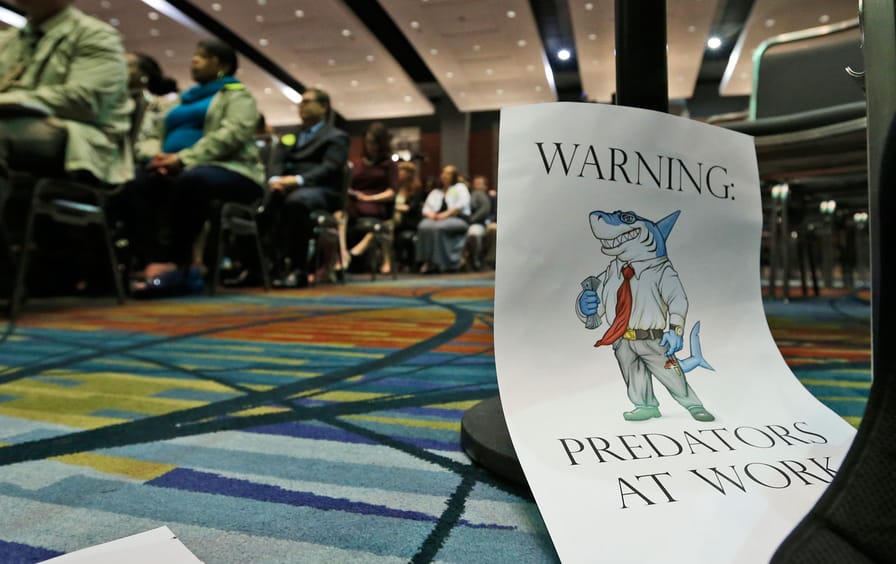

Biden often recommend several the fresh new specifications built to manage charges for clients, including the focusing on from business landlords and personal equity enterprises, that have been implicated of illegal suggestions sharing, price fixing, and you can inflating rents, the White Family told you.

The brand new chairman also reference this new administration’s combat into the nonsense costs, focusing on those people that endure extra can cost you regarding the leasing software processes and you will about time of a lease underneath the guise off convenience costs, the newest White House said.

And you may Biden is expected to call to the Congress to help build local rental assist with more than 500,000 domiciles, and additionally giving a voucher be sure to have lowest-earnings veterans and you may teens ageing out of promote worry.

Homes relationship solutions

Housing relationships such as the Home loan Bankers Connection (MBA) additionally the National Houses Conference (NHC) easily responded to the news headlines. The fresh new NHC lauded the development.

This is the really consequential State of your Union target with the housing much more than just 50 years, NHC Chairman and you will Chief executive officer David Dworkin said. President Biden’s need Congress to experience the newest immediate matter-of homes cost using income tax loans, downpayment advice efforts, and other steps is warranted and you can represents a vital part of easing the burden regarding large rents and home prices.

MBA President and President Bob Broeksmit explained that as the association tend to review all of the proposals in-breadth, they welcomes the fresh new Biden administration’s work at reforms that grow single-family members and multifamily construction also have. It is extremely careful of a few of the proposals.

MBA keeps high questions you to definitely a number of the proposals into the closure will set you back and title insurance rates you’ll undermine individual defenses, raise exposure, and relieve battle, Broeksmit said. Recommendations that an alternative renovate of them regulations needs depart regarding the latest courtroom routine developed by Congress from the Dodd-Frank Operate and will simply improve regulating can cost you to make they untenable for quicker lenders to help you vie.